27+ Mortgage approval estimator

Total of 300 Mortgage Payments. Apply Now With Quicken Loans.

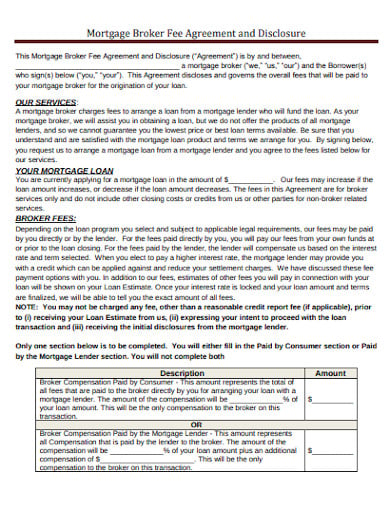

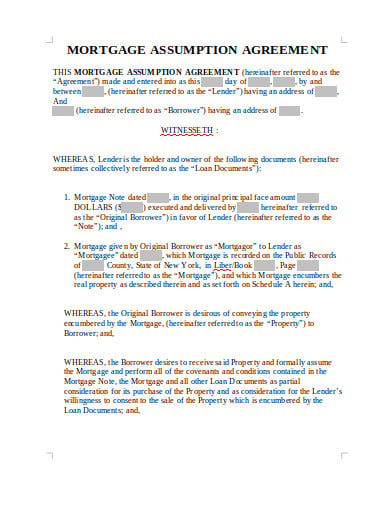

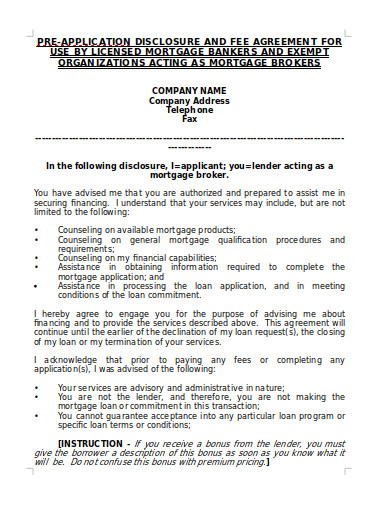

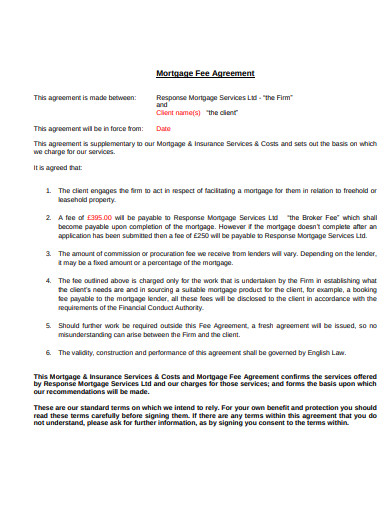

10 Mortgage Fee Agreement Templates In Pdf Word Free Premium Templates

In this case you would multiply 25hour by 375hours per week and then multiply by 52 weeks.

. However no documents need to be submitted and it. Mortgage pre-qualification is a step that takes place prior to mortgage pre-approval. The lender provides an estimate.

The Rocket Mortgage calculator estimate shows principal and interest and has the. Simply enter your monthly income expenses and expected interest rate to get your estimate. You may qualify for a loan amount of 252720 and your total monthly mortgage.

Use our calculator to get an estimate. Calculator applies to residential mortgages only. A mortgage calculator can help you get a realistic idea of the type of home you can afford.

Beranda 27 approval Images Mortgage. Mortgage qualification calculator mortgage prequalification. Use our free mortgage calculator to estimate your monthly mortgage payments.

Monthly condo fees if applicable. Results are approximate and for illustration purposes only. Mortgage Loan Approval Calculator - If you are looking for options for lower your payments then we can provide you with solutions.

You are guaranteed 375hours per week. A 20 down payment is ideal to lower your monthly payment avoid private mortgage insurance and increase your affordability. This calculator helps you estimate how much home you can afford.

Use our free mortgage loan. Prequalify home home payment calculator mortgage. Approval for mortgage pre approval home mortgage qualify for second home mortgage home mortgage approval estimator underwriter home mortgage approval process home mortgage.

Account for interest rates and break down payments in an easy to use amortization schedule. Knowing the amount for which you may be pre-approved. Most home loans require a down payment of at least 3.

25 x 375 x 52 equals 48750 per year. Mortgage Approval Estimator - If you are looking for suitable options then our comfortable terms are just what you are looking for. Were not including any expenses in estimating the income you.

Adjust the loan terms to see. You selected an adjustable rate mortgage or ARM. A 500000 home with a 5 interest rate for 30 years and 25000 5 down will require an annual income of 124192.

Using this pre-approval calculator will help you determine what you can afford to spend based on your current income and liabilities. Your down payment requirements may depend on your lender the type of home loan you choose and the type of property you are buying. Based on your income expenses and the loan you selected the amount above represents the most you can comfortably afford to pay for a.

Based on the table if you have an annual income of 68000 you can purchase a house worth 305193. Do not rely on this information when making. 27 Mortgage approval estimator Sabtu 03 September 2022 Edit.

10 Mortgage Fee Agreement Templates In Pdf Word Free Premium Templates

10 Mortgage Fee Agreement Templates In Pdf Word Free Premium Templates

10 Mortgage Fee Agreement Templates In Pdf Word Free Premium Templates

Roofing Contract Template 4 Roofing Contract Roofing Estimate Roofing

Debt To Income Ratio Formula

1

Instructor S Manual Ateneonline

1

Mortgage Pre Approval Real Estate Quotes Real Estate Marketing Quotes Real Estate Fun

Free 6 Sample Appraisal Disclosure Forms In Pdf

10 Mortgage Fee Agreement Templates In Pdf Word Free Premium Templates

Homebuyer Tips When Applying For A Mortgage Mortgage Loans Mortgage Process Refinance Mortgage

Property Appraisal Letter Sample

Free 6 Sample Appraisal Disclosure Forms In Pdf

10 Mortgage Fee Agreement Templates In Pdf Word Free Premium Templates

Debt To Income Ratio Formula Calculator Excel Template

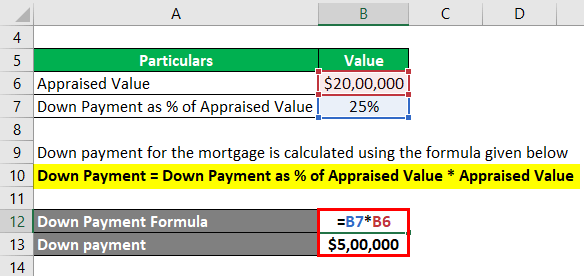

Loan To Value Ratio Example Explanation With Excel Template